Provinces on the mend

Blue-collar workers provide needed boost

- Published: 23 May 2016 at 06:30 0 comments

- NEWSPAPER SECTION: Business | WRITER: Kanana Katharangsiporn

A bird's-eye view of Pattaya City in Chon Buri province. The development of industrial estates in Chon Buri, Rayong and Chachoengsao is breathing new life into the property markets of the three provinces. PATIPAT JANTHONG

Real demand from blue-collar workers at industrial estates has helped revitalise the housing markets in Chon Buri, Rayong and Chachoengsao following bearish conditions a year ago.

Piya Prayong, president of value business of SET-listed developer Pruksa Real Estate Plc, says the single house and town house markets in Chon Buri for units priced between 1.5-2 million baht fared very well in the first quarter of this year.

"A majority of homebuyers in this segment were people working on industrial estates," he says. "These people represent real demand as they are first-time homebuyers who wanted to own their own homes. Their income was quite stable, which helped them to secure mortgages easily."

The Bangkok-based developer entered the Chon Buri housing market four years ago, undertaking a total of six projects to date.

This year it plans to launch three new projects in Chon Buri and will expand to Rayong, as the province will be the site of new industrial estates, which will create future housing demand.

The government last month asked the Industrial Estate Authority of Thailand (IEAT) to seek land plots sized 4,000 rai in the eastern provinces of Chon Buri, Rayong and Chachoengsao to develop a special economic zone for high-tech clusters.

The IEAT says there are 19 industrial estates in these three provinces where a total of 7,000 rai has been set aside for new developments. There are also 12 industrial estates under development covering 20,000 rai.

Mr Piya says Pruksa's planned project in Rayong entails 300 town houses priced from 1.5 million baht a unit on a 30-rai site in the district of Pluak Daeng. The project has been valued at 1 billion baht.

Market research by Pruksa has revealed that the value of the housing markets in Chon Buri and Rayong in the first quarter totalled 15 billion baht, rising 9% over the same period last year.

The value of these two eastern provinces' housing markets in the first quarter accounted for 53% of the total housing market in six major provinces; the other four being Phuket, Chiang Mai, Khon Kaen and Songkhla. Total market value was 28.3 billion baht, up 11% year-on-year.

In Chon Buri, the largest growth was in the town house segment, which increased 60% to 2.9 billion baht in the first quarter this year, followed by condos, which rose 12% to 7.9 billion baht, and single houses, up 4% to 2.4 billion baht.

Pairoj Wattanavarodum, senior executive vice-president of MAI-listed developer J.S.P. Property Plc, says the growth of town houses was larger than that of single houses, with most of the town house demand coming from blue collar workers and newly-wed couples.

"Most town houses in eastern provinces are priced 1.5-2.5 million baht a unit. This price is affordable for blue collar workers and newlyweds who usually rent a residential unit and need to buy one of their own," says Mr Pairoj.

Meanwhile, single house demand in the eastern region comes primarily from white collar workers, middle managers and entrepreneurs from small and medium-sized enterprises who already own their own homes. They rarely buy a new one if they are not confident in the economy, he adds.

J.S.P. is expanding to Chon Buri, with plans to develop a large-scale project worth 15 billion baht in Bang Saray, Sattahip on a 161-rai site. The project will be undertaken as a joint venture with Chinese contractor Zhongtian Construction Group.

Mr Pairoj says J.S.P. has just entered the eastern region, starting with Chachoengsao, where it launched a low-rise housing project worth 1.6 billion baht last month.

"Housing demand in Chachoengsao, Ban Pho district is from Toyota Motor Thailand, local people employed in the Muang district and those working in the Bang Na-Trat area of Bangkok, as it's located nearby," he says.

J.S.P. is also looking for two plots sized 50 rai each in Si Racha and Pattaya, Chon Buri, to develop low-rise projects, including town houses priced 1.5-2 million baht and single houses priced 2.5-3 million baht a unit.

"A healthy residential market in the provinces depends mainly on demand that is both local and real. Those provinces should not only have tourist destinations but also workplaces or industrial estates as well as educational institutions. Chon Buri is among them," says Mr Pairoj.

According to the Real Estate Information Center (REIC), the residential markets in Chon Buri and Rayong in the third quarter last year saw a recovery of their monthly absorption rates over the same period in 2014.

In Chon Buri, the monthly absorption rate for low-rise houses (single houses and town houses) and condos improved to 6.7% and 7.1%, respectively, in the third quarter of 2015, up from 4.7% and 5.1% in the same period of 2014.

The monthly absorption rate for low-rise houses and condos in Rayong also jumped to 6% and 5.3% from 4.1% and 3.9% over the same time frame, respectively.

The sales rate for low-rise housing and the condo supply in Chon Buri last year improved to 68% and 79% from 60% and 73% in 2014, respectively, despite having dropped from 71% and 76% in 2013.

In Rayong, the sales rate for low-rise housing and the condo supply were 61% and 70%, up from 56% and 64% in 2014, respectively, following a drop from 69% each in 2013.

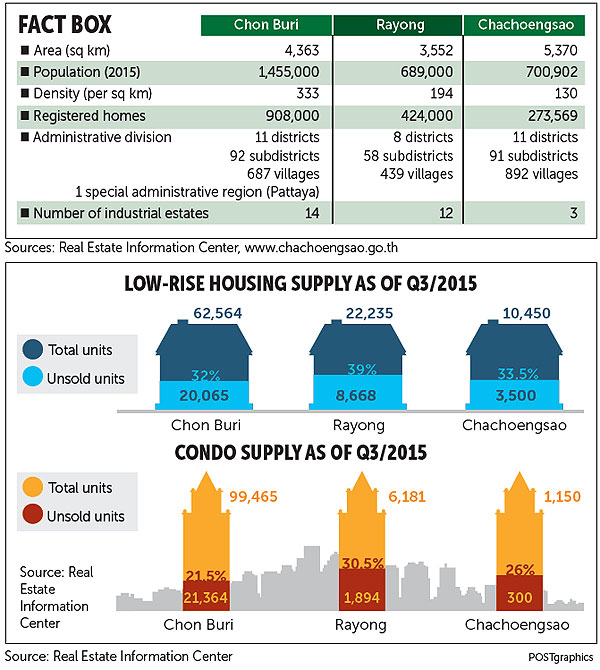

REIC reported there were a total of 62,564 low-rise units worth a combined 175 billion baht in Chon Buri as of the end of the third quarter last year. Of this number, 20,065 units valued at 57.5 billion baht are still up for sale.

The condo supply in Chon Buri totalled 99,465 units worth a combined 280 billion baht during the same period. Of this number, 21,364 units valued at 61.9 billion baht are still up for sale. Unit numbers and value of both low-rises and condos in Chon Buri are the second largest nationwide, following Bangkok.

In Rayong, low-rise housing supply totalled 22,235 units valued at 58.5 billion baht, with 8,668 units worth a combined 22.7 billion baht still unsold. Condo supply totalled 6,181 units with a value of 12.2 billion baht, of which 1,894 units worth 4.16 billion baht are still up for sale.

In Chachoengsao, the low-rise housing supply totalled 10,450 units worth a combined 29.3 billion baht, of which 3,500 units valued at 9.3 billion baht remain unsold. Condo supply in the town totalled 1,150 units valued at 940 million baht, of which 300 units worth 250 million baht remain up for sale.

Tritecha Tangmatitham, managing director of SET-listed developer Supalai Plc, says the Chon Buri property market excluding Pattaya has seen continued growth every year due largely to demand from people working on industrial estates.

Supalai has developed six residential projects worth 5.8 billion baht in Chon Buri and two projects worth 1.9 billion baht in Rayong. It plans to launch two new projects each in Chon Buri and Rayong worth 3.6 billion baht this year.

"[The market in] Pattaya is driven by foreign demand. When it slowed, the market largely dropped, leaving too much supply," says Mr Tritecha. "Unlike Pattaya, market growth in places such as Muang, Bang Saen, Si Racha or Laem Chabang is gradual, driven by industrial estates."

It also has five plots of land in Chon Buri slated for low-rise developments with a total sales value of 2.5 billion baht. They include two plots sized 30 rai and 50 rai in Bang Saen, a 20-rai site in Si Racha and two plots sized 20 rai and 30 rai in Pattaya.

According to the REIC, 66% of the condo supply in Chon Buri -- 65,220 units worth 170 billion baht -- is in Bang Lamung District, where Pattaya is located.

Of the total condo supply in Bang Lamung, 13,107 units with sales value of 41.63 billion baht -- 20% of total supply -- are still up for sale as of the third quarter last year.

In Chon Buri alone, there were a total of 41,429 residential units worth a combined 119.38 billion baht still up for sale.

0 people commented about the above

Readers are urged not to submit comments that may cause legal dispute including slanderous, vulgar or violent language, incorrectly spelt names, discuss moderation action, quotes with no source or anything deemed critical of the monarchy. More information in our terms of use.

Please use our forum for more candid, lengthy, conversational and open discussion between one another.

Click here to view more comments