Housing boost imminent

Fee cuts, relaxed loan terms for homebuyers

- Published: 01 Oct 2015 at 06:46 0 comments

- NEWSPAPER SECTION: Business | WRITER: Wichit Chantanusornsiri & Kanana Katharangsiporn

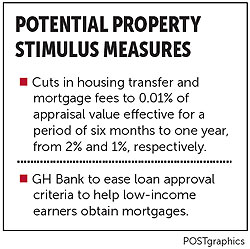

A reduction in transfer and mortgage fees to 0.01% for a period of six months to a year and GH Bank's relaxed housing loan criteria for low-income earners will form the backbone of stimulus measures seeking cabinet approval early this month.

The potential fee cuts are aimed at alleviating homebuyers' burden, a Finance Ministry source said without providing further details on which home prices would qualify.

The fee reduction would lower local administrations' revenue, with the government then subsidising them to maintain a revenue ratio of 27% of government revenue as required by law, the source said.

The specific business tax -- a levy on property developers when they sell to homebuyers and on property owners who resell their property within five years of it being transferred to them -- would be kept unchanged at 3.3%, the source said.

The Finance Ministry has no plans to cut the specific business tax, viewing the sluggish market as largely a result of tightened housing loan approvals by banks.

Finance Minister Apisak Tantivorawong recently identified mortgage approvals as the main problem in the real estate sector, as rejection rates by financial institutions are high and low-income borrowers have trouble obtaining home loans.

Commercial banks' rejection rates for housing loans are as high as 60%, up from 20% in normal times.

Mr Apisak has said property is one of several sectors the government plans to revive through the use of incentives.

Housing transfer and mortgage fees now sit at 2% and 1% of appraisal value, respectively.

The Thai government has cut housing transfer and mortgage fees as well as the specific business tax twice before -- in 1997 after the country fell into financial meltdown and again in 2001.

The 2001 package cut transfer and mortgage fees both to 0.01% and the specific business tax was 0.1% of appraisal value.

The source said the Finance Ministry had asked the state-backed GH Bank to ease loan approval criteria such as the minimum debt-servicing ratio requirement and introduce a mortgage repayment period capped at age 60 for borrowers.

GH Bank president Angkana Chaimanat said the relaxed terms would be submitted for board approval today.

The bank is ready to loosen lending conditions and has set aside up to 10 billion baht for new loans, she said.

GH Bank lends for a maximum 30-year mortgage term, and 80-90% of the bank's borrowers have a 20-year term loan.

Regarding no-interest loans, Mrs Angkana said they were unnecessary in the current market situation.

Separately, the Finance Ministry source said measures to help farmers ride out next year's expected drought were under consideration.

The measures include debt suspensions, debt payment rescheduling and cheap loans to encourage farmers to switch to less thirsty crops or other careers.

Alongkot Boonmasuk, head of housing loan product management and marketing at Kasikornbank, said the measures would help to speed up housing transfers and reduce existing inventory.

However, uncertainty remains over whether they will spur purchasing power and investment in new projects amid gloomy economic prospects, he said.

Amonthep Chawla, head of research at CIMB Thai Bank, agreed with Mr Alongkot that the main issue for the lacklustre property market was deteriorating purchasing power.

Issara Boonyoung, honorary president of the Housing Business Association, said the new stimulus package would help to revive the weak housing market.

"It's been proved [in the past] that these incentives work when the country's economy slumps," he said.

"This will directly benefit homebuyers as the burden of home ownership lessens."

The effective period is likely to be extended to between six and 12 months as a way of clearing unsold condominium supply due to be completed within the next year, Mr Issara said.

The incentive will build up homebuyers' confidence and ease their purchase decisions, especially after new appraisals are applied next Jan 1.

Surachet Kongcheep, an associate director at property consultancy Colliers International Thailand, foresees many sales events once the incentives get the cabinet's nod.

"We'll see developers hold events for ready-to-move-in houses and condo units from the fourth quarter onwards," he said.

0 people commented about the above

Readers are urged not to submit comments that may cause legal dispute including slanderous, vulgar or violent language, incorrectly spelt names, discuss moderation action, quotes with no source or anything deemed critical of the monarchy. More information in our terms of use.

Please use our forum for more candid, lengthy, conversational and open discussion between one another.

Click here to view more comments